Inventory

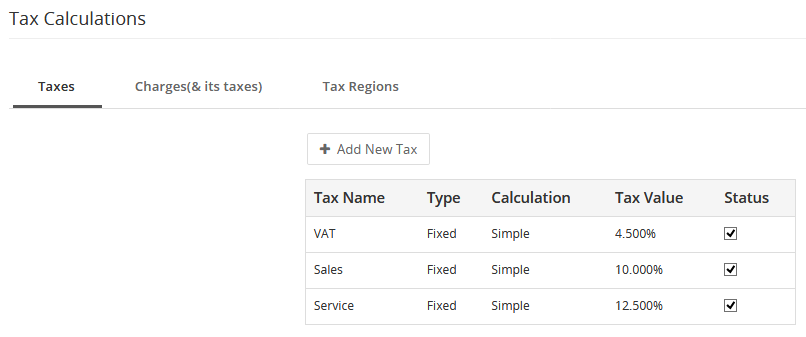

Tax Management

Terms and Conditions

- Tax is a fee charged (“levied”) by a government on a product, income, or activity.

- SalesHiker CRM gives you the flexibility to manage local and international tax rates through Tax Calculations. After the tax rates are defined, they will be available for selection in Invoices, Purchase Orders, Sales Orders and Quotes.

- Taxes defined in Tax Calculations are global, not product specific.

Follow few simple steps:

- Click gear icon

in the upper left.

in the upper left. - Click settings.

- Click CRM settings.

- Click INVENTORY.

- Click Tax Management. You can click on

pin icon next to it to add a shortcut to your settings home page.

pin icon next to it to add a shortcut to your settings home page.

Tax Management includes the following tabs, added newly

- Taxes

- Charges(& its taxes)

- Tax Region

1. Taxes

- Adding New Tax

This feature enables you to create National and International taxes.

You can edit the Tax, for updating it with desired values. You can also enable/disable the existing tax .i.e, Status. All the tax values that are enabled in Tax Calculations will be available for selection in the Products module. Also, the tax rates in Invoices, SO, PO, and Quotes will be calculated against taxes that are enabled in Tax Calculations. To be precise, the taxes, if disabled in Tax Calculations, will be simply ignored and not used for calculating taxes.- Tax Types

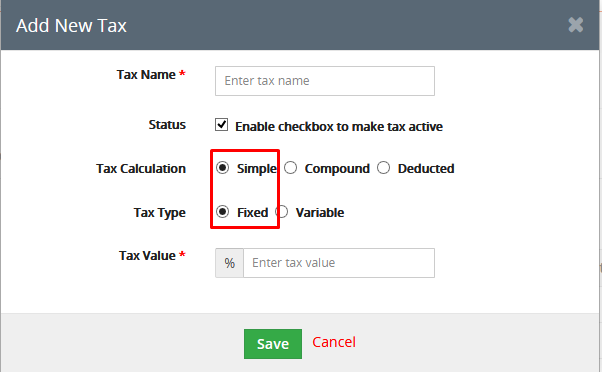

- Fixed – It’s the default value or fixed value .

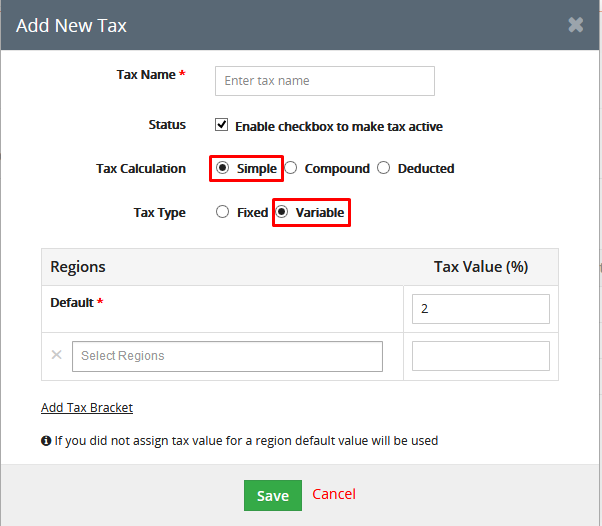

- Variable – It’s the type of tax whose value depends on the tax region.

- Tax Calculation

- Simple

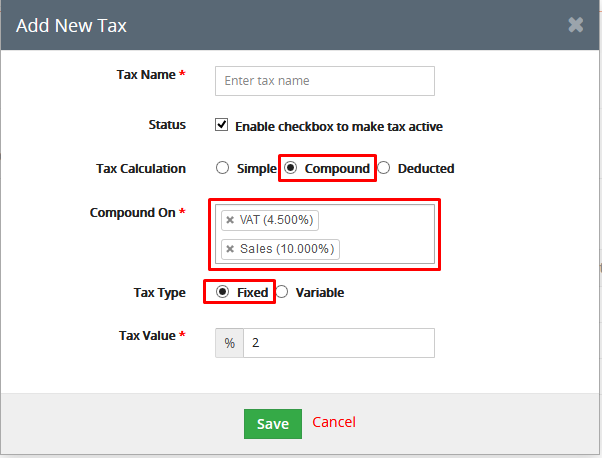

- Compound

- Deducted

- Tax Types

- Simple Tax- It is applied on Item total after discount. Simple, Fixed – Simple Tax like VAT , Service Tax, Sales Tax, etc can be fixed i.e, the Tax value once added remains unchanged throughout.

Simple, Variable – Adding a simple tax when the tax type value is specified based on region.If the value is not specified for the region, then the default value would be considered.

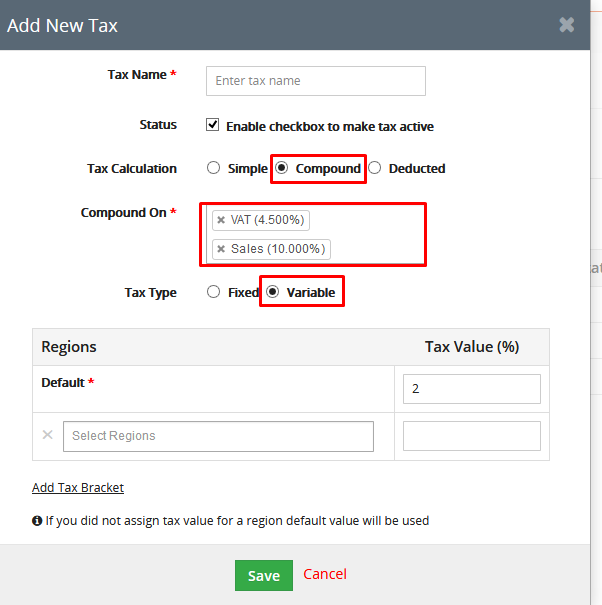

Compound Tax- It is a tax that is calculated on top of one or more simple taxes. - Compound, Fixed – A compound Tax for which the Tax Value specified is fixed. In the above example Eg 1 the Tax value 2% cannot be changed. It is fixed.

Note! A Compound Tax cannot have another compound tax within it.

Compound, Variable – Adding a compound tax when tax type value is specified based on regions.In the above example Eg 1 the Tax Value 2% can be changed depending on the regions.

Note! Once the tax has been created with any tax type it cannot be changed to another type like Simple Tax cannot be changed to Compound Tax or vice-versa.

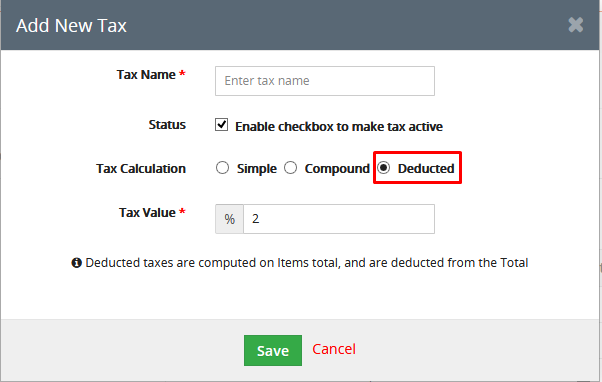

- Deducted Tax- It is the Tax value deducted on the Items Total in any of the Inventory. The Tax value added for the Deducted Tax in the Tax Calculation Settings can be changed in any of the Inventory.

Eg: The Deducted Tax value is set to 2% in the Tax Calculation Settings. On creating the Invoice you can change the Deducted Tax to 2.5%.

Note! The Deducted Tax shouldn’t be applied or make any changes on the Compound Tax.

- Simple Tax- It is applied on Item total after discount. Simple, Fixed – Simple Tax like VAT , Service Tax, Sales Tax, etc can be fixed i.e, the Tax value once added remains unchanged throughout.

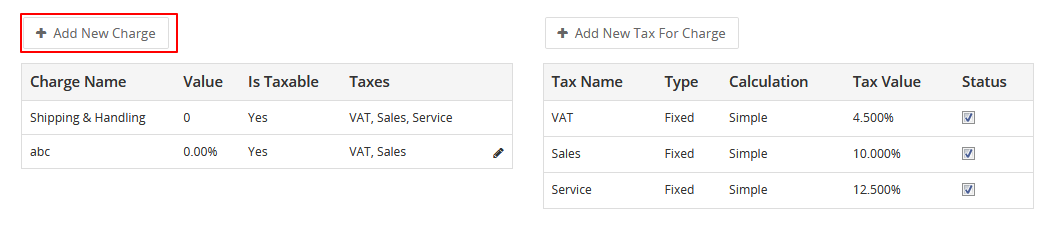

2. Charges

A charge is any additional fee that isn’t a product or service, and is applied to the item total on Invoices and Quotes and Sales Orders, such as Shipping and Handling, or a delivery charge.

Add new charge

Adding a new charge will have a specific value assigned for that charge above all the taxes included within it.

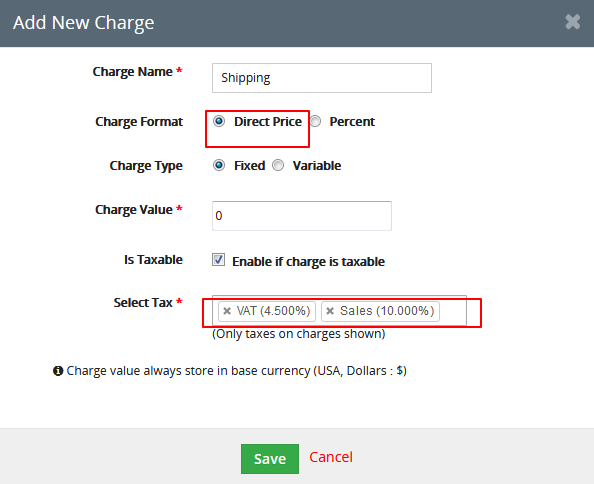

Charge Format

(i) Direct Price

(ii) Percent

(i) Direct Price:

The value which has been specified will be added directly into the “Charge” Field.

For Eg: Adding the charge for the product in terms of value not percentage. Say product cost is $250 and the Charge value added is $2.

(ii) Percent:

It will add percentage value regarding the Item Total field value.

For Eg: Adding the charge for the product in terms of percentage. Say product cost is $250 and the Charge value added is 2% of the Charge.

Charge Type

- Fixed : It’s the default charge value for all regions.

- Variable : Different values of charges can be assigned for different regions.

Charges can be applied for specific regions also. Any region specified within the tax in the Tax for Charge field will be applied for a Charge that includes this tax.

Charge Value

The Charge Value in the Add New Charge, is the default value that will appear in the Item Total under any of the Inventory. The same can be changed later.